Rental property depreciation calculator

This rental property calculator allows the user to enter all. Calculate The Depreciation Schedule For Rental Property Things are not always straightforward.

Free Construction Cost Calculator Duo Tax Quantity Surveyors

Website 9 days ago Use this calculator specifically to calculate depreciation of residential rental or nonresidential real property.

. The whole amount is 126000. To calculate the ROI of a property take the estimated annual rate of return divide it by the property price and then convert it into a percentage. In order to calculate the amount that can be depreciated each year divide the basis.

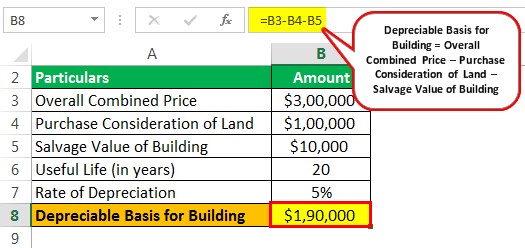

The result is 126000. Divide the base by the recovery time to get the amount depreciated each year. Total Depreciation - The total amount of depreciation based upon the difference.

Calculate Understand Your Potential Returns. Since you spread the depreciation deduction over 275 years you take the cost basis of the building not the land and divide it by 275 years to calculate your annual. One simple way to think about cap rate is the amount an investor will pay today for a future revenue stream.

An ROI of over 10 is a good deal assuming. Ad We Can Help You Bring In Prospective Tenants Too With Our Free Rental Listings. How is rental property depreciation calculated in real life time for an example.

Calculate 90 percent of 140000 to get the rentals base. Returns between 5-10 are reasonable for rental properties if youve included some conservative cushions for annual repairs vacancy rate etc. An example of real estate depreciation this is making my head spin.

To find out the basis of the rental just calculate 90 of 140000. Ad Property Can Be An Excellent Investment. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value.

You bought a home in june. Depreciation in real estate is basically a. If you buy a property that trades at an 8 cap rate then raise the net.

A rental property depreciation calculator can be a great tool for investors looking to find out the depreciation on their rental property. 369000 property cost basis 275 years 1341818 annual depreciation expense So over the four-year holding period the investor was able to claim a depreciation expense of 5367272. We Can Calculate Rent Prices Based On Location and Apartment Size.

Plan Your Property Investment Returns With AARPs Investment Property Calculator. Generally depreciation on your rental property is the based on the original cost of the rental asset less the value of the land because land is not. Rental properties are known to yield.

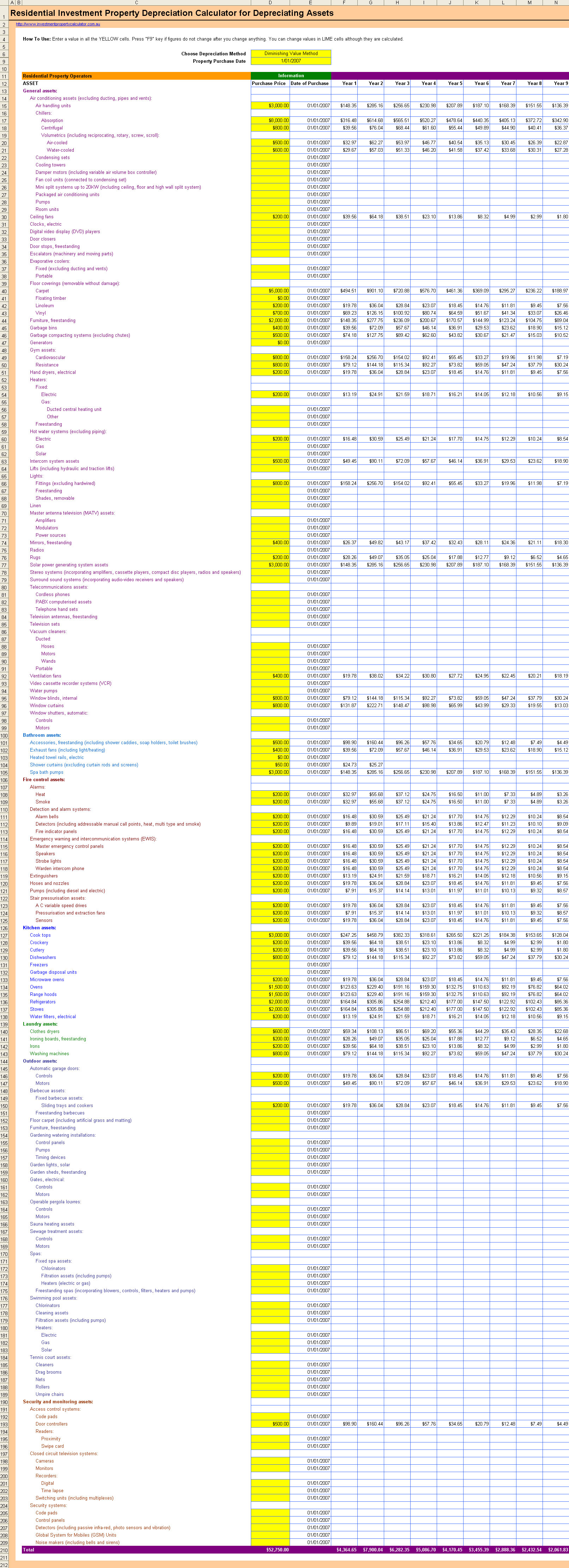

A real estate investor can claim a depreciation expense of 36 yearly. IQ Calculators provides a free rental property calculator for its site visitors that automatically calculates depreciation.

How Depreciation Claiming Boosts Property Cash Flow

Macrs Depreciation Calculator With Formula Nerd Counter

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Free Macrs Depreciation Calculator For Excel

Depreciation For Rental Property How To Calculate

Straight Line Depreciation Calculator And Definition Retipster

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

Straight Line Depreciation Calculator And Definition Retipster

A Guide To Property Depreciation And How Much You Can Save

Macrs Depreciation Calculator Straight Line Double Declining

Rental Property Depreciation Rules Schedule Recapture

Depreciation Of Building Definition Examples How To Calculate

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

How Is Property Depreciation Calculated Rent Blog

How To Use Rental Property Depreciation To Your Advantage

Free Investment Property Depreciation Calculator

Rental Property Depreciation Rules Schedule Recapture